Increase Your Profitability

How do you ensure your trade initiatives are moving the needle?

When scaling your foodservice sales, maintaining and increasing your profits can be a complicated puzzle. Selling to countless distributors and local operators makes it hard to keep track of account health, the use of your trade dollars, and double-dipping that eats away at your potential profits.

CHALLENGE:

getting what you paid for

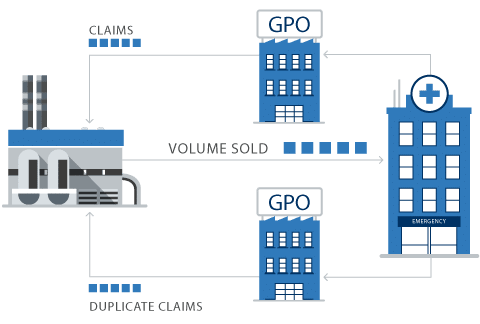

You offer deeper trade rates based on promises of volume growth. During contract renewal negotiations or RFPs, you assess the incremental volume needed to maintain margin dollars in exchange for deeper trade investment; if volume growth falls short, margin drops. Tracking Operator performance is not as straightforward. Accurately assessing an Operator’s volume delivery can be difficult. We’ve found that operator sales volume can be overstated up to 30%, typically due to duplicate claims (some for valid stacked deals, others for invalid double-dips) and unverified transactions. If deals are made with sub-GPO’s or other sub-groups within a larger contract, isolating their volume adds one more layer of complexity

CHALLENGE:

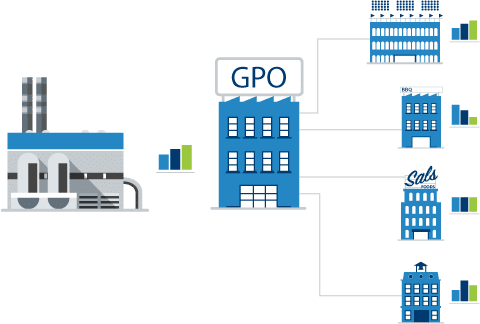

measurable real GPO growth

CMC’s and GPO’s use volume growth to push for increased trade rates. As this volume is indirect, separating true growth from account shifts is difficult. While significant moves are easier to isolate—like Dining Alliance moving from Foodbuy to Sodexo—the majority of affiliation changes are made by thousands of small operator Ship-to’s.

CHALLENGE:

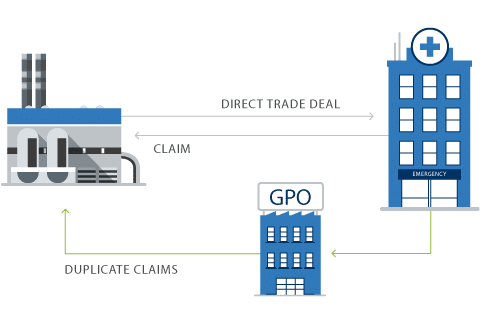

Preventing Claim to Claim Double Dips

Non-commercial operators are big culprits in double dips. Trade programs with GPOs and CMCs have become increasingly complex, and the amount of data to analyze ever vaster. You don’t have an analyst team with the experience or time to commit to an audit. And yet, you need to stop operator ship-to locations with direct trade deals from being claimed by a GPO or CMC.

CHALLENGE:

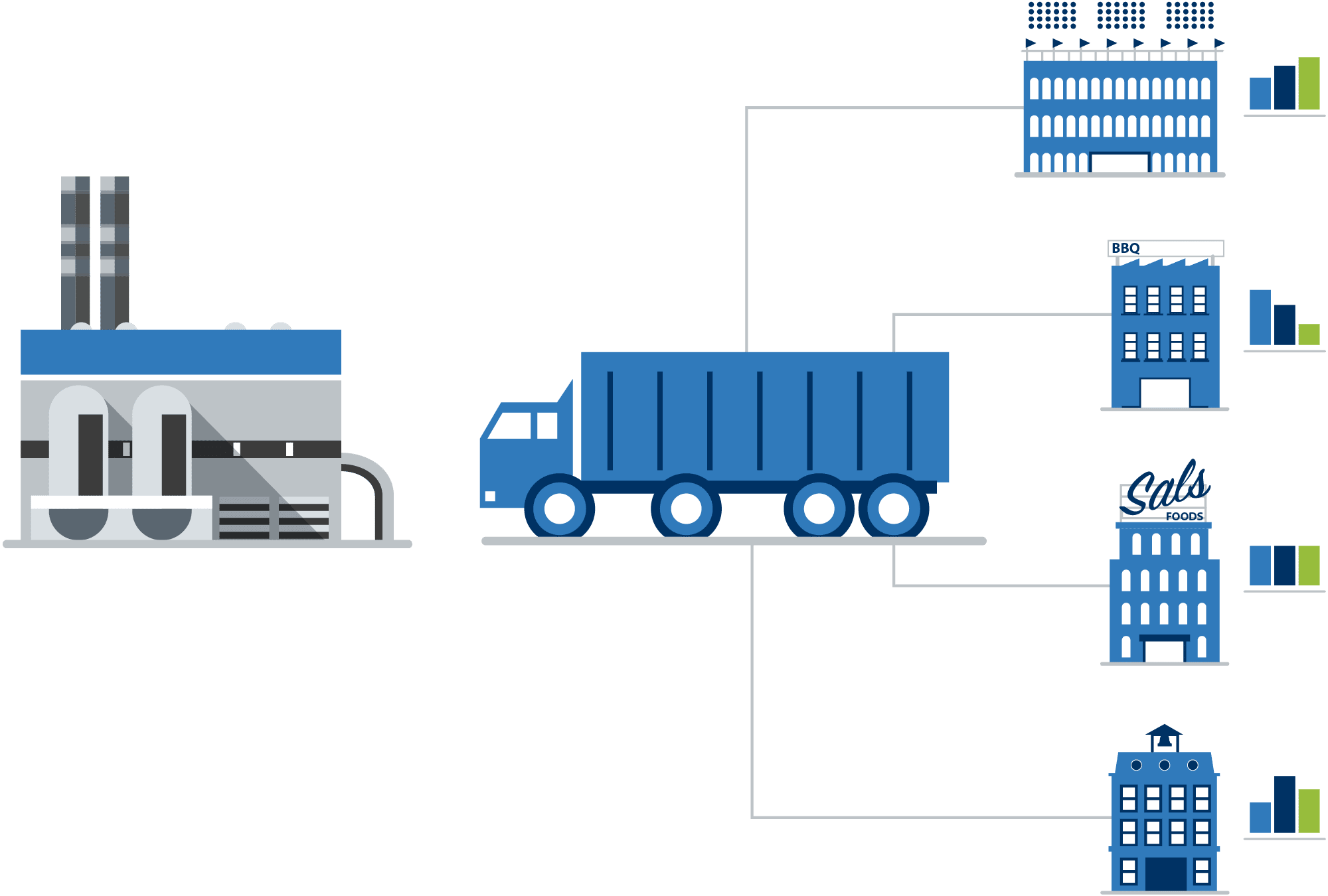

Negotiating With Distributors

A typical distributor review focuses on outbound volume by category because this data is most readily available. You might also review high-level trade spend, promotions, and slots. However, knowing the mix of operators results in a better understanding of performance drivers and puts you in a stronger negotiating position.